It can be derived from immovable properties and movable properties. According to the Income Tax Act rental income of a property is taxed under Section 24 in the hands of the owner under the head income from house property.

Itr 5 Indian Income Tax Return Income Tax For Ngos

Relevant Provisions of the Law The provisions of the ITA related to.

. Part 3Finding Taxable Income. Landlords of qualifying non-residential properties would also have received a cash grant in 2020 and are required to. Now in 2019 the time has come for property owners to begin claiming that exemption on their income tax forms.

Rental income is assessed on a net basis. You can deduct as a rental expense 10 of any expense that must be divided between rental use and personal use. Generally this amount will be your taxable income from your rental property.

The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. No expenses losses or capital deduction allowances shall be allowed for deduction from the gross. Your entire house has 1800 square feet of floor space.

The idea is that income from the renting of residential properties would receive a 50 exemption from income tax. The tenants are entitled to use the swimming pool tennis court and other facilities that are provided in the apartment. And 13 how all properties of a person are to be grouped in several categories in computing the statutory income under section 4d of the Act.

Subtract your total expenses on Line 20 from your total income on Line 3 and enter the result on Line 21. For instance they include. Such rental income is explained under Section 4d of the Act.

And b Letting of real property as a non-business source under paragraph 4d of the ITA. If the amount is. However the rent earned by letting out vacant land is not taxed under this category but is.

Rent is usually 30 of the regular cost after accounting for necessary expenses. Landlords of qualifying non-residential properties can refer to the Tax Treatment of Rental Relief Measures under the Rental Waiver Framework for Year of Assessment 2022. Azrie owns 2 units of apartment and lets out those units to 2 tenants.

Income received from the letting of the real property is charged to tax as rental income under paragraph 4 d of the ITA. It is payable when landlords receive rent from their tenants either monthly quarterly semi-annually or annually. If your heating bill for the year for the entire house was 600 60 600 010 is a rental expense.

The room is 12 15 feet or 180 square feet. The legalese gets complicated so lets break. In Malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d Rental income of the Income Tax Act 1967.

12 the situations or circumstances where rent or income from the letting of property can be treated as business income of a person under section 4a of the Act. LIRC reduces the property class rate applied to. S4 a Business Income letting of real property as a business source under paragraph 4 a of ITA.

Rental Income is calculated using the net amount. The waiting lists can take years and even then tenants may have to relocate. Before declaring your rental income to LHDN you should start from the rental income sources.

S60F 2 Investment holding company letting of real property as investment holding under S60F 2 of ITA. Residential rental income is charged at a flat rate of 10 on gross rent received per month. When computing the rental gain to be disclosed in tax filings the gross rental income can.

However returns must be filed monthly. To get the net amount you have to deduct permitted expenses incurred from the gross rental income. Section 8 housing which subsidizes private landlords on behalf of low-income households has even more stringent income and eligibility restrictions than public housing.

Tax class 4d should be expanded to include 1 income- and rent-restricted units currently excluded by a provision that at least 75 of the units on a property meet certain eligible requirements and 2 projects funded only by local governments. A Letting of real property as a business source under paragraph 4a of the Income Tax Act 1967 ITA. The Low Income Rental Classification LIRC.

For rental income received in 2021 Under the Rental Relief Framework owners ie. Individuals who own property in Malaysia and receive a rental income will be subjected to income tax. This was introduced in Section 4 d of the Income Tax Act 1967 ITA.

There are mainly 3 sections of the Income Tax Act 1967 ITA that will attract taxes on rental income as explained. This is provided for in Section 4d of the Income Tax Act 1967.

Alabama Federal Income Tax Deduction Worksheet Download Printable Pdf Templateroller

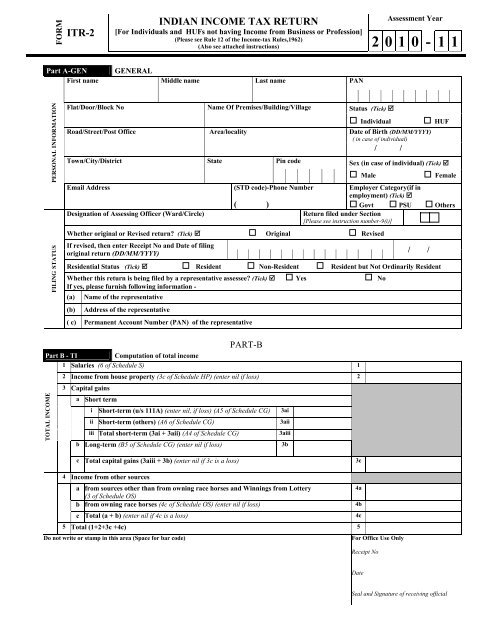

Rm Itr 2 Indian Income Tax Return Income Tax For Ngos

Income Tax Return Forms In India India Briefing News

Rm Itr 5 Indian Income Tax Return Income Tax Department

What Landlords Need To Know About Schedule E Form Landlord Studio Tax Deductions Being A Landlord Property Tax

Why Hra Generator Is Important Income Tax Income Tax Return Tax Refund

How To Keep Track Of Rental Property Expenses Rental Property Spreadsheet Template Rental Property Management

Pin By Bianca Kim On W 2 Irs Tax Forms Internal Revenue Service Classroom Newsletter Template

Format Personal Tax Docx Format Income Tax Payable For Individual Ali Rm S 4a Business Income 1 Gross Income Less Allowable Expenses Adjusted Course Hero

Alabama Federal Income Tax Deduction Worksheet Download Printable Pdf Templateroller

Income Tax Return For Financial Year 2020 2021 A Y 2021 22 Manthan Experts

Solved Put The Given Details Below In The Bir Form 1700 For Mixed Earner Course Hero

Pin By Bianca Kim On W 2 Irs Tax Forms Internal Revenue Service Classroom Newsletter Template

Getting To Know Gilti A Guide For American Expat Entrepreneurs

- cara cepat untuk ricih kan daun

- standing in the eyes lirik

- produk untuk hilangkan parut jerawat hitam

- model rambut laki lucu

- penilaian bersepadu pegawai perkhidmatan pendidikan online

- nama bayi lelaki islam huruf r

- cara menyikat rambut mengikut sunnah

- khasiat minyak zaitun kepada rambut

- hvide spisebordsstole plast

- contoh kad jemputan vip

- manusia pendek ilmu hitam

- cara bersihkan ketiak yg hitam

- gambar obesiti kartun

- tracking poslaju j&t express

- gambar pemadam kartun hitam putih

- kata arah kata adjektif kata sendi nama

- gambar grafiti nama sendiri online

- perlembagaan persekutuan malaysia pdf

- kalori sup ayam lada hitam

- resepi seri muka pulut hitam